MINING ASSOCIATION OF BRITISH COLUMBIA (MABC)

PRE-BUDGET CONSULTATIONS 2011 for BUDGET 2012

Executive Summary

The MABC is the pre-eminent voice of mining in the province of British Columbia, speaking on behalf of mine operators, smelters, advanced development companies and some exploration companies.

Our mandate is to encourage the ethical discovery, development and operation of mining and related facilities in the province of British Columbia. MABC and its member companies place a high priority on issues of sustainability and environmental responsibility, as evidenced by the recent adoption of MABC members of Towards Sustainable Mining (TSM), a globally recognized accountability framework for the mining industry. Presently the MABC and its member companies are working with the government of British Columbia to undertake scientific research that will inform the discussion of both provincial and federal regulatory improvements. MABC has worked with government on the development of climate action policies that address green house gas emissions (GHGs) while ensuring the long-term viability of the mining and smelting industries in the province.

While the workforce demand of the mining industry in British Columbia continues to grow, BC's mining industry is steadfast in its commitment to health and safety, and is today the safest heavy industry in the province. With three pilot sites in British Columbia, the Mining Industry Human Resources sector council launched a national credentialing initiative in 2010 as an industry led initiative to incent people to choose a career in mining. The increasing demand for workers will require that the evolving national labour market is well understood. It is also critical that programs are developed to promote attraction, recruitment and retention to our industry, and that training and education programs that target aboriginal people, women and new Canadians are supported.

MABC would like to express its appreciation and gratitude to the Government of Canada for acting on the requests from MABC submitted during last year's budget consultation regarding amendments to the Canadian Environmental Assessment Act.

Moving forward, MABC is pleased to recommend the following measures that would assist BC's mining sector in capitalizing on the opportunities that lie before it as Canada continues down the path of economic recovery and works to eliminate its deficit. MABC's recommendations are as follows:

- MABC recommends that the federal government invest in human capital research and training initiatives like the Sector Council program MiHR (Mining Industry Human Resources) sector council, and the former ASEP (Aboriginal Skills and Employment Program).

- MABC recommends that the federal government invests in the innovative future of the mining industry by supporting the Canadian Mining Innovation Council. The role of the CMIC is to strengthen mining research and improve the competitive nature of a responsible mining sector in Canada.

- MABC recommends that the existing funding levels for the Major Project Management Office be renewed to ensure that recent improvements to the federal regulatory review process are maintained and built upon. In order to realize the enormous potential for mining investment in British Columbia it is critical that both the federal and provincial environmental assessment processes and subsequent authorization and permitting processes are conducted in a timely, efficient, and consistent manner that reduces redundancies and promotes ethical mining practices.

- MABC recommends that the super flow-through share incentive be enhanced for a limited period to encourage exploration and better position Canada for the post recession period. To facilitate long-term planning, the 15% Mineral Exploration Tax Credit should be extended for a further two years to match British Columbia's parallel extension.

The BC Mining Industry

There are currently 20 coal and metal mines operating

safely in the province, two smelters, over 30 industrial mineral operations,

over 20 projects at different stages of development and over 350 exploration

projects. One of the province's largest export-oriented industries, mining is

very important to rural and remote communities across the province, paying the highest

wages of any industrial sector.

There are currently 20 coal and metal mines operating

safely in the province, two smelters, over 30 industrial mineral operations,

over 20 projects at different stages of development and over 350 exploration

projects. One of the province's largest export-oriented industries, mining is

very important to rural and remote communities across the province, paying the highest

wages of any industrial sector.

While mining is often an economic cornerstone in rural and remote communities, the sector's importance to Vancouver should not be overlooked. The city is home to approximately 800 mining and mineral exploration companies of various sizes, including major international companies such as Teck Resources and GoldCorp. Over 400 related consultant and supplier companies support the sector, including geological/geotechnical, law and accounting firms.

While Vancouver competes in some fashion with international mining centres such as London, Toronto and Perth, the city is clearly the world's centre for mineral exploration and sells its expertise around the globe. BC is Canada's largest coal producer, 90% of which is high quality steel-producing coal. Coal has a big future in the province, which hosts an estimated 20 billion tonnes of reserves. Almost exclusively exported, coal generated 51% of provincial mining revenues in 2010, derived from sales almost entirely outside Canada. BC's top coal markets, from largest to smallest, are Japan (33%), South Korea (20%), Germany (7%), Brazil (6%), United Kingdom (5%), Taiwan (5%), Netherlands (4%), Italy (4%) and Turkey (4%). China and India remain under-exploited potential markets for BC steelmaking and thermal coal.

Approximately 75% of BC's metal and mineral products are exported, with Japan being the destination for about 50% of the total product[i]. One quarter of product is sold within Canada for the domestic market. British Columbia is Canada's largest producer of copper, representing 21 % of the province's mineral revenues in 2010[ii]. BC is also the country's only producer of molybdenum. Other BC mineral products include gold, silver, zinc, lead, magnesite, gypsum, limestone, aggregate and dimension stone.

Current Context

With the economic and financial crisis of 2008 largely behind us, the private sector has now taken over from the government in stimulating the economy. In spite of recent short-term market volatility, in the long run, private sector investment is critical to ensuring that the economic recovery continues and to allow governments to begin focusing on deficit reduction. Increased revenues from industry will play a key role in providing the resources to restore government's fiscal position. Over the last year commodity prices have risen significantly (for example, copper has risen from its low of US$1.30 in 2008 to a Ql 2011 value of US$4.38/lb). Mines that scaled back have, for the most part, restored production levels, hired back laid-off workers and resumed plans for expansion and new project development. Most companies have also seen their stock prices recovered to levels that reflect the current trends in our sector.

The economic picture for BC's mining industry continues to be a bright spot as it enters into a growth phase not seen in over a decade. Actions by governments around the world to address the liquidity crisis have started to take hold and commodity prices have more than recovered. The 2011 price for metallurgical (steel-making coal) reached US$181/tonne and the copper price continues a steady rise, up from US$3.40/lb in 2010 to US$4.38/lb in the first quarter of 2011. The prices of molybdenum and zinc, two other important BC commodities, have also recovered to a modest degree. As a result, not only is BC's mining industry on a much stronger footing today than it has been in a long time, signs of growth are everywhere: two new mines, Copper Mountain and New Afton, both brownfield redevelopments made feasible in part by rising commodity process, are in full scale construction, with Copper Mountain officially reopening in August this year. The Mt. Milligan project has also moved into full construction. It is also important to note that several BC mines currently in production are planning for or implementing significant expansions including Teck Resources' Highland Valley Copper mines and Line Creek Coal mine, as well as Thompson Creek Metals' Endako mine.

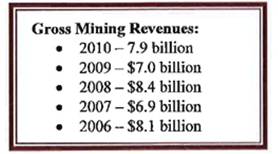

The British Columbia mining industry posted financial results that were no less than inspiring. There is much to be excited about in the PricewaterhouseCoopers (PwC) annual report on mining, Seize the Day: The Mining Industry in British Columbia in 2010. Gross mining revenues rose $.9 million to $7.9 million in 2010 over the $7 million in 2009. Returns on shareholders investments in BC's operating mines, based on pre-tax earnings, increased from 44% in 2009, to 62.9% in 2010.

As BC's mining sector cements its recovery and continues to grow, it is poised to capitalize on the demand for minerals and metals in emerging markets in Asia, particularly China and India. BC is extremely well-positioned to meet this growing demand, though increasing demands for a diversely skilled workforce could impact some operations, particularly in rural and remote locations. The province's mineral potential is among the best anywhere, hosting vast reserves of steel-making coal and metals such as copper, gold and molybdenum. The long-term prognosis of a robust mining sector underscores the importance of taking action to protect BC's mining investments and Vancouver's preeminence as a global exploration centre and to continue to position the province as a major global supplier of commodities, mining supplies and services to the emerging markets.

Recommendations

MABC makes the following recommendations to assist BC's mining sector in capitalizing on the opportunities that lay before it, for the benefit of all British Columbians and for Canada:

Human Resources

Total salary and benefits in the industry totaled $886 million in 2010 compared to $852 million in 2009, and increase of 7%. The average salary continues to hover above $105k/year. Unfortunately, the training hours reported dropped 62%, with less than half as much money invested in education in 2010 compared to 2009. Without the investment in basic workplace skills, trades, and professional programs, the industry will fall short in terms of meeting its labour needs locally. With unemployment remaining comparatively high in rural communities,(especially so in aboriginal communities), providing the tools for participation in the mining industry is a critical investment in communities and families.

- MABC recommends that the federal government invest in human capital research and training initiatives like the Sector Council program MiHR (Mining Industry Human Resources) sector council, and the former ASEP (Aboriginal Skills and Employment Program).

Research and Development

The mining industry invests some $650 million annually in R&D, more than that of key sectors such as automotive, forest products and oil extraction. The industry feels that federal entities do not provide support commensurate with these needs and priorities - far greater support levels are seen in other sectors. Toward this end, the recently-created Canada Mining Innovation Council (CMIC) is in discussion with government agencies with the aim of enhancing support to the industry's priorities. Governments should be prepared to respond to these needs by supporting the innovative future of the industry on a scale seen in other sectors.

- MABC recommends that the federal government invests in the innovative future of the mining industry by supporting the Canadian Mining Innovation Council. The role of the CMIC is to strengthen mining research and improve the competitive nature of a responsible mining sector in Canada.

Tax/Budget Incentives

British Columbia's mining sector is undergoing an era of unprecedented growth with the potential to realize over $12 billion in capital investment to build new mines in virtually every region of our province. The intent of the following budget measure would be to maintain existing capacity within the federal regulatory review regime.

- MABC recommends that the existing funding levels for the Major Project Management Office be renewed to ensure that recent improvements to the federal regulatory review process are maintained and built upon. In order to realize the enormous potential for mining investment in British Columbia it is critical that both the environmental assessment process and subsequent authorization and permitting processes are conducted in a timely and consistent manner.

British Columbia's Mineral reserves have been declining significantly since the early 1990's in all major base metals. The intent of the following tax/budget measure would be to maintain long term exploration investment competitiveness while helping to spur exploration activity as they continue to recover from the lows of 2008 and 2009 and work to reverse the trend of declining reserves.

- MABC recommends that the super flow-through share incentive be enhanced for a limited period to encourage exploration and better position Canada for the post-recession period. To facilitate long-term planning, the 15% Mineral Exploration Tax Credit should be extended for a further three years.

CONCLUSION

MABC thanks the House of Commons Standing Committee on Finance for this opportunity to provide a pre-budget submission. Our recommendations are focused on measures that would enable Canada to capitalize on the opportunities offered by BC's mining sector to emerge from the economic recession in a position of strength and to contribute to the well-being of Canadians.

[i] Ministry of Energy, Mines &

Petroleum Resources, Destinations of Major Metals from British Columbia, As

found December 22,2008 at:

http://www.empr.go.bc.ca/Mining/MineralStatistics/MineralSectors/MetaIs/MarketsandPrices/Pages/MarketDestination.aspx

[ii] PriceWaterhouseCoopers, Seize the Day: The Mining Industry In British Columbia in 2010, May 2011.